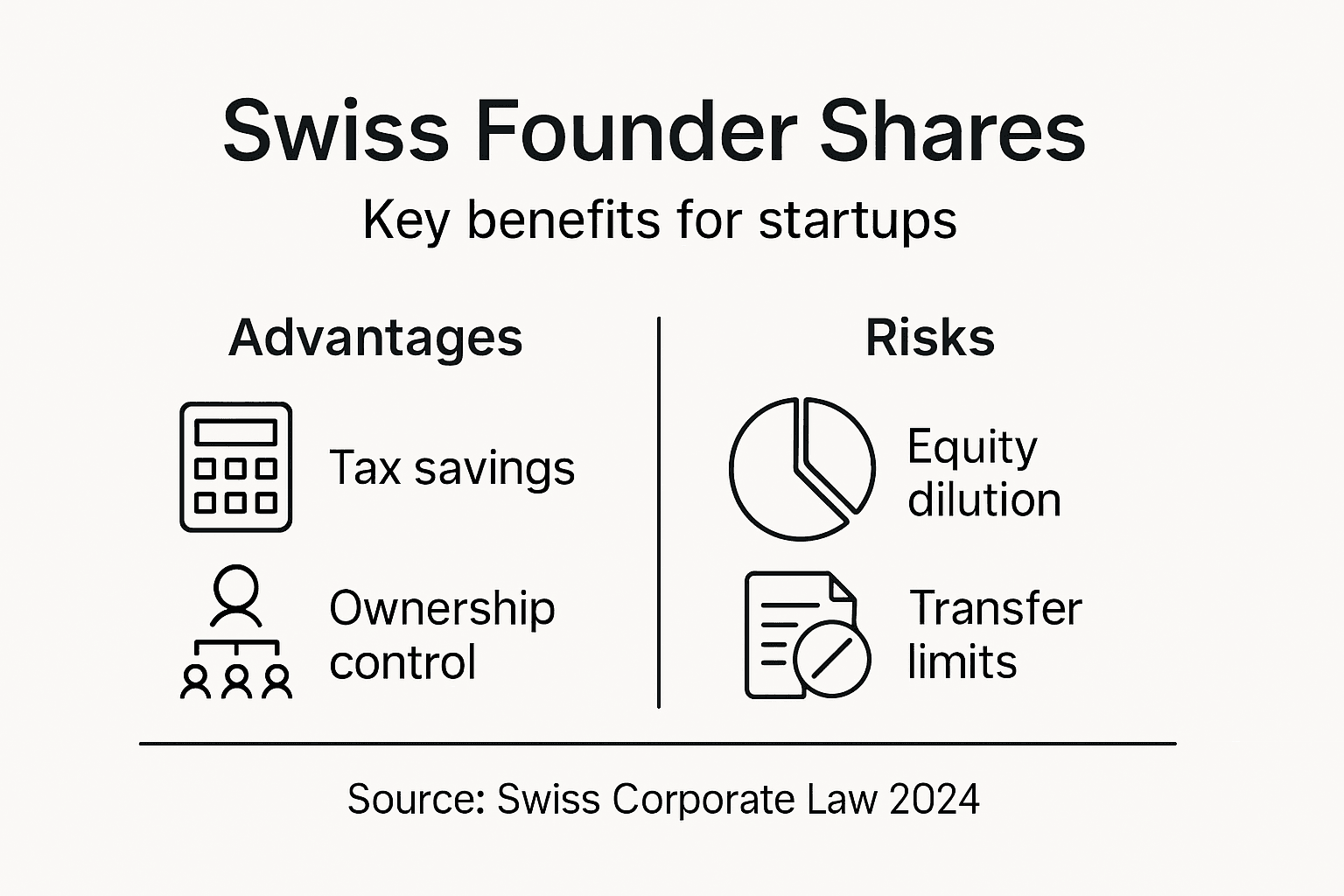

Founder Shares in Switzerland: Key Benefits for Startups

- Rolands Plotnieks

- Jan 7

- 7 min read

Updated: Jan 8

Many American tech founders discover that Switzerland’s streamlined company formation process attracts global entrepreneurs aiming for long-term growth. With a record number of new Swiss startups emerging every year, understanding how founder shares work is crucial for those seeking optimal ownership control and favorable tax treatment. This guide reveals how founder shares define legal compliance, financial rewards, and decision-making power when launching a GmbH or AG in Switzerland.

Table of Contents

Key Takeaways

Point | Details |

Importance of Founder Shares | Founder shares are essential for defining ownership and governance structures within Swiss startups. Understanding their categorization can significantly impact a company’s strategic direction. |

Types of Founder Shares | Swiss startup founders can utilize different share classes to tailor equity ownership, including ordinary, preferred, restricted, and performance-based shares, enhancing flexibility in governance and incentives. |

Legal and Transfer Restrictions | Founder shares in Switzerland come with specific transfer regulations that protect existing shareholders and ensure corporate integrity, requiring careful legal drafting for agreements. |

Tax Implications | Founders must navigate nuanced tax regulations regarding their shares, making tax advisory critical for optimizing financial outcomes and long-term wealth preservation. |

Founder shares in Swiss company formation

Founder shares form the critical financial foundation of Swiss companies, representing an entrepreneur’s initial investment and ownership stake in a new business venture. In Switzerland, these shares play a pivotal role in defining corporate governance, ownership structure, and capital allocation for startups across various legal entities like AG (Aktiengesellschaft) and GmbH (Gesellschaft mit beschränkter Haftung).

Understanding the nuanced landscape of founder shares requires insight into Swiss corporate regulations. Record number of startup formations highlights the robust entrepreneurial ecosystem in Switzerland, where founders can strategically structure their equity ownership. Typically, founder shares in Swiss companies can be categorized into different classes with varying voting rights, dividend entitlements, and transfer restrictions.

Key characteristics of founder shares in Switzerland include:

Precise legal documentation defining ownership percentages

Flexibility in creating different share classes

Clear regulations governing share transfer and valuation

Transparent mechanisms for equity distribution

The Swiss legal framework provides significant advantages for founders, enabling them to design share structures that align with their strategic objectives. Entrepreneurs can leverage these provisions to protect their interests, attract potential investors, and establish a solid corporate governance model.

Pro tip: Consult with a Swiss corporate legal expert to design founder share agreements that optimize tax efficiency and protect your long-term business interests.

Types of founder shares and distinctions

In Switzerland, founder shares represent more than simple equity ownership. They are sophisticated financial instruments with complex legal and strategic implications. Founder equity shares detail ownership structures through precise documentation that defines each founder’s contributions, rights, and responsibilities within the corporate framework.

Founder shares in Swiss companies typically fall into several distinct categories:

Ordinary Shares: Standard equity representing baseline ownership

Preferred Shares: Offering additional voting rights or dividend preferences

Restricted Shares: Subject to specific transfer or vesting conditions

Performance-Based Shares: Tied to individual or company milestone achievements

The Swiss regulatory environment provides remarkable flexibility for structuring these share types. Unlike many jurisdictions, Switzerland allows founders significant latitude in designing share agreements that protect individual interests while maintaining transparent corporate governance. Shareholder rights can vary significantly based on the specific share class, enabling entrepreneurs to create nuanced ownership models that align with their strategic vision.

Here’s a comparison of common founder share types in Swiss startups:

Share Type | Key Advantages | Common Use Case |

Ordinary Shares | Standard rights, easy transferability | Baseline founder ownership |

Preferred Shares | Priority dividends, enhanced voting | Attracting key investors or executives |

Restricted Shares | Controlled vesting, retention tool | Keeping founders committed long-term |

Performance Shares | Linked to milestones, incentivizing | Rewarding achievement of company targets |

Key considerations when establishing founder shares include determining voting power, defining potential dilution scenarios, establishing transfer restrictions, and creating mechanisms for potential future equity adjustments. These intricate details require careful legal drafting to ensure all founders’ interests are comprehensively represented and protected.

Pro tip: Engage a Swiss corporate lawyer specializing in startup equity to design a founder share agreement that balances flexibility with long-term protection of your entrepreneurial interests.

Legal status and transfer restrictions

Founder shares in Switzerland are subject to intricate legal frameworks that govern their transfer, ownership, and potential restrictions. Share transfer rules in Swiss law establish complex mechanisms designed to protect corporate integrity and founder interests, particularly within different company structures like GmbH and AG.

The legal landscape for founder share transfers involves several critical considerations:

Approval Requirements: Many Swiss companies mandate shareholder consent for share transfers

Preemptive Rights: Existing shareholders often have first refusal on share purchases

Valuation Mechanisms: Specific rules governing how shares are valued during transfer

Restriction Clauses: Potential limitations on selling or transferring shares within specified timeframes

These transfer restrictions serve multiple strategic purposes. They prevent unexpected ownership changes, maintain the carefully curated composition of founding teams, and protect the company’s long-term strategic vision. For instance, in a GmbH, shareholders might require unanimous approval before a founder can sell their equity stake, ensuring that only mutually agreeable parties can enter the corporate structure.

The table below summarizes the main legal and strategic impacts of transfer restrictions on founder shares:

Transfer Restriction | Typical Purpose | Impact on Founders |

Approval Requirements | Prevent unwanted new shareholders | Founders keep greater control |

Preemptive Rights | Allow first refusal to current owners | Protects ownership balance among founders |

Valuation Mechanisms | Fair pricing during transfers | Reduces conflict over share value |

Restriction Clauses | Limit share sales within timeframe | Maintains original founding team stability |

Understanding these legal nuances is crucial for founders. The restrictions are not mere bureaucratic hurdles but sophisticated tools for maintaining corporate stability. Detailed shareholder agreements must precisely articulate transfer conditions, potential exit scenarios, and the rights of each equity holder to prevent future conflicts and misunderstandings.

Pro tip: Consult a Swiss corporate attorney to draft comprehensive shareholder agreements that anticipate potential transfer scenarios and protect your entrepreneurial interests.

Rights, obligations, and dilution risks

Founder shares in Switzerland represent a complex balance between entrepreneurial autonomy and strategic corporate governance. Founder-investor partnerships demand careful navigation of rights, obligations, and potential equity dilution that can fundamentally reshape a startup’s ownership structure.

Key rights and obligations associated with founder shares include:

Voting Rights: Determining strategic company decisions

Economic Entitlements: Claiming dividends and financial returns

Governance Responsibilities: Participating in board-level discussions

Fiduciary Duties: Maintaining ethical and legal standards

Information Rights: Accessing critical company financial and operational data

Dilution represents a significant risk for founders, particularly during subsequent funding rounds. External investment can progressively reduce founders’ percentage ownership, potentially diminishing their control and economic stake. Sophisticated founders mitigate this risk through carefully structured shareholder agreements that preserve voting power, implement anti-dilution provisions, and establish clear mechanisms for maintaining meaningful influence even as new investors enter the corporate landscape.

The intricate dance of rights and obligations requires founders to balance immediate financial needs with long-term strategic control. Founders must understand that each funding round potentially redistributes equity, making proactive negotiation and strategic foresight critical to maintaining their vision and influence within the company they have created.

Pro tip: Develop a comprehensive equity strategy that anticipates multiple funding scenarios and protects your founding team’s strategic interests through meticulously crafted shareholder agreements.

Tax and financial impact on founders

Founder shares in Switzerland carry nuanced tax implications that require strategic financial planning. Swiss financial reporting standards create a complex framework where founders must navigate intricate tax regulations and accounting requirements that directly impact their economic outcomes.

Key tax and financial considerations for founders include:

Capital Gains Treatment: Potential tax advantages for long-term equity holdings

Wealth Tax Implications: Annual assessments on shareholding values

Dividend Taxation: Progressive tax rates depending on ownership structure

Equity Compensation Rules: Special provisions for stock-based compensation

Loss Offset Mechanisms: Strategic approaches to managing financial risk

The Swiss tax environment offers unique advantages for entrepreneurs. Founders can benefit from relatively low corporate tax rates, sophisticated loss carry-forward provisions, and a legal framework that encourages entrepreneurial investment. Tax benefits for entrepreneurs demonstrate how strategic share structuring can minimize tax liabilities while maintaining substantial founder control.

Navigating these financial complexities requires deep understanding of Swiss corporate tax law. Founders must carefully document capital contributions, understand the tax implications of different share classes, and develop proactive strategies that balance immediate financial needs with long-term wealth preservation. Professional tax advisory becomes crucial in optimizing the financial potential of founder shares.

Pro tip: Engage a Swiss tax specialist who understands startup equity to develop a comprehensive tax strategy that maximizes your financial efficiency and protects your entrepreneurial investments.

Secure Your Founder Shares with Expert Swiss Company Formation Support

Navigating the complex legal and tax landscape of founder shares in Switzerland can be overwhelming for international entrepreneurs. The challenge lies in structuring share classes that protect your ownership, define clear voting rights, and mitigate dilution risks while optimizing tax outcomes. At rpcs.ch, we understand these critical nuances and provide tailored solutions to streamline the formation of your Swiss AG or GmbH. Our comprehensive services include expert legal documentation, shareholder agreement drafting, and strategic tax planning so you can focus on growing your startup with confidence.

Protect your founder equity and set your business up for long-term success with professional guidance that ensures full compliance alongside rapid company setup. Visit rpcs.ch now to access dedicated support for Swiss company formation, legal structuring of founder shares, and ongoing administrative assistance. Take action today to secure your entrepreneurial future and leverage Switzerland’s unrivaled business advantages.

Frequently Asked Questions

What are founder shares and why are they important for startups?

Founder shares are the equity representing an entrepreneur’s initial investment and ownership stake in a new business. They play a crucial role in defining corporate governance, ownership structure, and capital allocation for startups.

What types of founder shares are available in Switzerland?

Founder shares can be categorized into several types, including ordinary shares, preferred shares, restricted shares, and performance-based shares, each with unique rights and obligations.

How do transfer restrictions impact founder shares?

Transfer restrictions are legal mechanisms that govern how and when founder shares can be sold or transferred, helping to maintain corporate stability and protect the interests of existing shareholders.

What are the potential tax implications for founders holding shares?

Founders may face various tax implications, including capital gains treatment, wealth tax assessments, dividend taxation, and rules regarding equity compensation, making tax strategy vital for financial optimization.

Recommended