How to Choose Swiss Company Structure for Crypto Startups

- Jan 20

- 8 min read

Choosing the right Swiss company structure can feel daunting for foreign fintech entrepreneurs entering the crypto payment services market. With global crypto adoption on the rise and evolving rules from organizations like the International Monetary Fund, strategic decisions matter more than ever for legal compliance and operational success. This guide highlights the critical steps to assess your objectives, weigh AG versus GmbH features, and meet regulatory standards so you can establish your Swiss crypto business with confidence.

Table of Contents

Quick Summary

Key Insight | Explanation |

1. Assess Business Goals | Evaluate your specific business objectives and regulatory landscape before choosing a company structure. |

2. Compare AG and GmbH | Understand differences between AG and GmbH to align your choice with business strategy and investor needs. |

3. Determine Compliance Needs | Ensure compliance with AML and KYC regulations to protect your business and investors in the crypto environment. |

4. Engage Expert Consultants | Consult legal and financial experts specializing in Swiss crypto regulations to navigate complexities effectively. |

5. Maintain Ongoing Compliance | Keep a compliance calendar to track registration and reporting obligations, ensuring legal standing and transparency. |

Step 1: Assess Business Goals and Sector Requirements

Choosing the right Swiss company structure for your crypto startup demands strategic evaluation of your specific business objectives and regulatory landscape. The crypto sector presents unique challenges that require careful navigation, especially when establishing an international presence.

First, conduct a comprehensive analysis of your business model and operational requirements. This means examining your target markets, anticipated transaction volumes, and potential regulatory interactions. Comprehensive policy frameworks from international organizations like the International Monetary Fund suggest that crypto businesses must align their structural decisions with evolving regulatory expectations. Consider questions like whether you need a payment service license, plan to handle client funds, or intend to offer trading platforms.

Your assessment should include evaluating the specific requirements for crypto businesses in Switzerland. This involves understanding capital requirements, compliance obligations, and potential tax implications. Different company structures like GmbH or AG offer varying levels of flexibility and regulatory oversight. Pay special attention to global regulatory frameworks that might impact your business model, particularly if you plan cross-border operations.

Pro Tip: Consult with a Swiss legal expert specializing in fintech regulations to get precise guidance tailored to your specific crypto business model and international expansion plans.

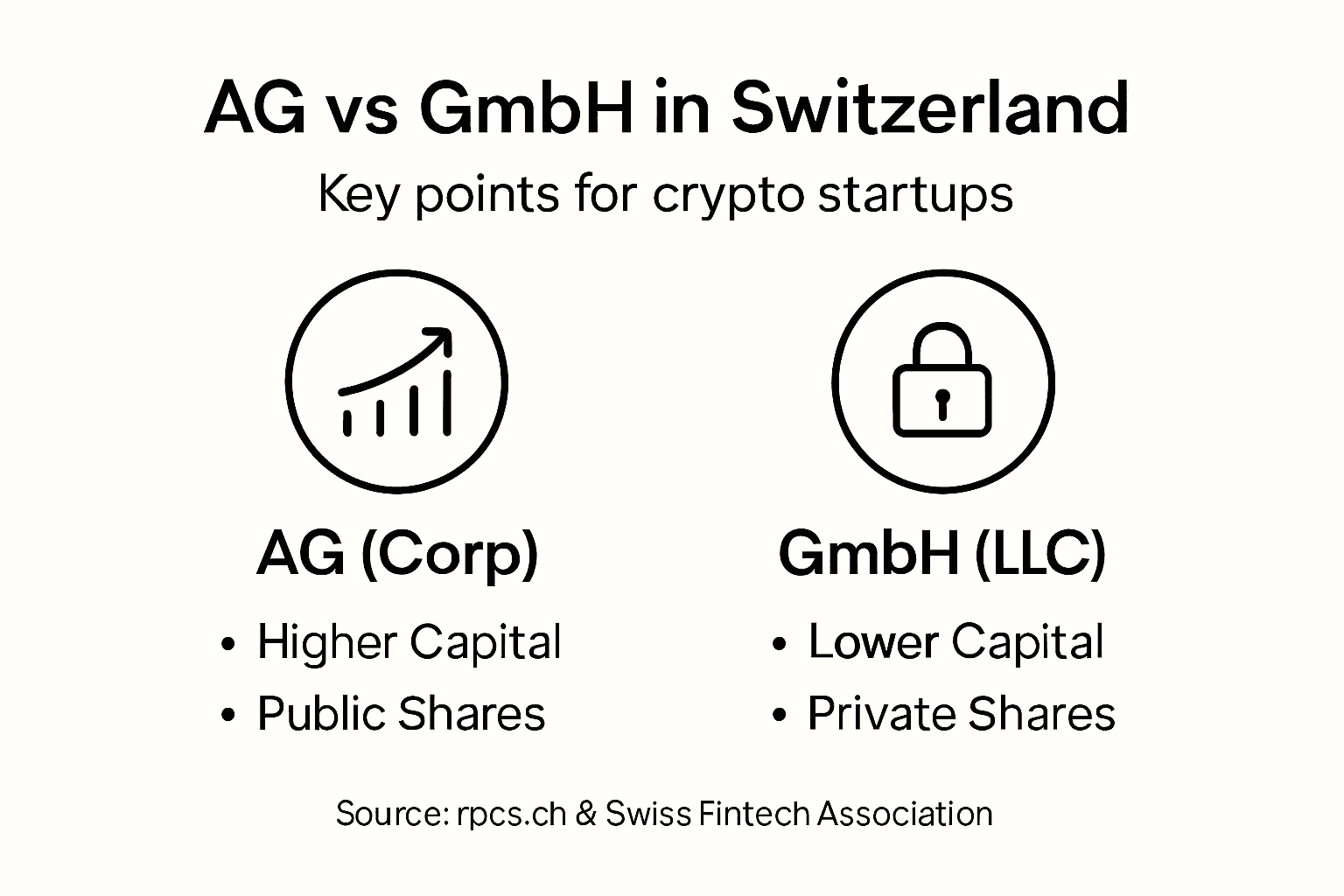

Step 2: Analyze AG and GmbH Features for Crypto Businesses

Analyzing the right corporate structure is critical for your Swiss crypto startup. Understanding the nuanced differences between Aktiengesellschaft (AG) and Gesellschaft mit beschränkter Haftung (GmbH) will help you make an informed decision that aligns with your business strategy and regulatory requirements.

The key distinctions emerge in capital requirements and management structures. An AG provides greater flexibility for larger investments and offers more anonymity for shareholders, making it attractive for crypto businesses seeking significant external funding. This structure allows for public share offerings and can accommodate multiple investors more easily. Conversely, a GmbH works best for smaller crypto ventures with fewer stakeholders, offering more personalized management and lower initial capital requirements.

For crypto startups, your choice depends on several strategic factors. An AG might suit businesses planning rapid scaling or seeking international investment, while a GmbH could be ideal for closely held operations with more direct operational control. Consider your fundraising plans, desired investor anonymity, and long-term growth strategy when making this critical decision. Comparing GmbH and AG structures can provide additional insights into which model best matches your specific crypto business objectives.

Here is a concise comparison of AG and GmbH structures for Swiss crypto startups:

Criteria | AG (Aktiengesellschaft) | GmbH (Gesellschaft mit beschränkter Haftung) |

Minimum Capital | CHF 100,000 | CHF 20,000 |

Shareholder Anonymity | High, public share offerings permitted | Low, ownership publicly registered |

Investor Attraction | Suits global investors and large funding rounds | Better for closely held, smaller ventures |

Management Control | Board of directors, formal structure | Direct, personalized governance |

Suitability | International, scalable crypto businesses | Small teams with direct operational involvement |

Pro Tip: Always consult a Swiss corporate law specialist who understands the unique regulatory landscape of crypto businesses to ensure your chosen structure provides maximum operational flexibility and compliance.

Step 3: Determine Investor, Liability, and Compliance Needs

Navigating the complex landscape of investor requirements, liability exposure, and regulatory compliance is crucial for your Swiss crypto startup. Your company structure will directly impact how you manage financial risks and meet legal obligations in the rapidly evolving digital asset environment.

Liability considerations for Swiss companies reveal critical distinctions that can significantly affect your business strategy. In a GmbH structure, liability is typically limited to company assets, with shareholders personally responsible only for unpaid capital contributions. This means you need to carefully evaluate potential financial risks and ensure adequate capital allocation to protect your investors and operational capabilities.

The regulatory landscape demands comprehensive compliance strategies. Crypto startups must adhere to stringent anti-money laundering (AML) and know-your-customer (KYC) policies. Policy recommendations for crypto markets emphasize the importance of transparent risk disclosure and operational standards. Your chosen company structure should provide flexibility for meeting these evolving regulatory requirements while maintaining investor protection and operational integrity.

Pro Tip: Engage a Swiss legal specialist with specific expertise in crypto regulations to perform a comprehensive compliance audit and help you design a robust risk management framework tailored to your specific business model.

Step 4: Consult Experts to Finalize Your Company Structure

The final and most critical step in establishing your Swiss crypto startup involves securing expert guidance to validate your strategic decisions. Bringing in multidisciplinary professionals will help you navigate the complex regulatory and structural landscape with precision and confidence.

Expert consultation strategies reveal the importance of engaging specialists who understand the intricate nuances of crypto business formation. Your consulting team should ideally include legal experts specializing in Swiss corporate law, financial regulatory compliance professionals, tax advisors with crypto sector experience, and technology compliance specialists who understand blockchain and digital asset frameworks.

When selecting your expert consulting team, prioritize professionals with demonstrable experience in Swiss crypto regulations and international digital asset markets. Look for advisors who can provide comprehensive insights into structural considerations such as investor protection mechanisms, cross-border operational strategies, and scalability potential. How to Appoint Swiss Director for Your Company Easily can offer additional guidance on securing qualified local representation for your startup.

Pro Tip: Schedule initial consultations with at least three different expert teams to compare perspectives and ensure a comprehensive assessment of your company structure before making final decisions.

Step 5: Verify Registration and Ongoing Obligations

Successfully registering your Swiss crypto startup requires meticulous attention to legal and administrative details. This final verification stage ensures your company meets all regulatory requirements and maintains its legal standing in Switzerland.

Commercial registration requirements mandate comprehensive documentation and ongoing compliance for both GmbH and AG structures. You must ensure your company is properly registered with the Swiss Commercial Register, which formally establishes your legal entity and subjects your business to specific reporting and governance standards. This process involves submitting detailed corporate documents, confirming initial capital contributions, and providing proof of your company’s operational framework.

Ongoing obligations extend beyond initial registration. Your crypto startup must maintain accurate accounting records, hold regular shareholder meetings, comply with annual audit requirements, and submit timely financial reports. These responsibilities are critical for maintaining your company’s good standing and demonstrating transparency to regulators, investors, and potential business partners. Implementing a robust compliance management system will help you track and meet these continuous regulatory expectations effectively.

Below is a summary of ongoing compliance and operational obligations for Swiss crypto companies:

Obligation | AG Companies | GmbH Companies | Business Impact |

Annual Audit Requirement | Mandatory for most AGs | Required if certain criteria | Increases transparency to investors |

Commercial Registration | Detailed disclosure needed | Detailed disclosure needed | Legally establishes company |

Financial Reporting | Annual, strict deadlines | Annual, strict deadlines | Essential for regulatory approval |

Shareholder Meetings | Regularly required | Regularly required | Ensures decision-making alignment |

Compliance Monitoring | Extensive for large firms | Important for all firms | Supports regulatory risk management |

Pro Tip: Create a dedicated compliance calendar that tracks all registration renewal dates, reporting deadlines, and mandatory meetings to ensure you never miss a critical administrative requirement.

Unlock the Ideal Swiss Company Structure for Your Crypto Startup

Choosing the perfect Swiss company structure is a critical step that can shape your crypto business’s future. From navigating complex liability issues to aligning with strict compliance and investor needs, you face many challenges that require expert support. Whether you lean toward an AG for international scaling or a GmbH for a tightly controlled venture, making the right choice now can save time, reduce risks, and accelerate growth.

Don’t let uncertainty slow your crypto startup’s potential. At rpcs.ch, we specialize in simplifying Swiss company formation with tailored solutions for crypto businesses. Our comprehensive services cover everything from legal documentation and registration to banking setup and ongoing compliance management. Benefit from our deep expertise in the nuances of AG and GmbH structures, regulatory requirements, and investor protection. Take control of your Swiss incorporation journey today and gain international credibility and stability. Visit rpcs.ch now to get started and explore how to appoint a Swiss director easily and secure your company’s future with confidence.

Frequently Asked Questions

What factors should I consider when choosing a Swiss company structure for my crypto startup?

To choose the right company structure for your crypto startup, assess your business goals, target markets, and regulatory requirements. Examine aspects such as transaction volumes and if you’ll handle client funds. Conduct this analysis early in the planning phase to ensure your structure aligns with your business model.

How do the features of AG and GmbH differ for crypto startups in Switzerland?

The main differences between an Aktiengesellschaft (AG) and a Gesellschaft mit beschränkter Haftung (GmbH) include capital requirements and management flexibility. An AG is suited for larger, international investments, while a GmbH is ideal for smaller businesses with fewer stakeholders. Evaluate your fundraising needs and scale plans to select the most suitable structure for your operations.

What are the compliance obligations for Swiss crypto companies after registration?

After registering your Swiss crypto startup, you must maintain accurate accounting records, hold regular shareholder meetings, and comply with annual audit requirements. Implement a compliance management system to track deadlines and required reports to ensure ongoing adherence to legal standards.

How can I ensure my chosen company structure meets regulatory requirements for crypto businesses?

Consult with a Swiss legal expert who specializes in fintech regulations to align your company structure with current rules. Their guidance can help ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) policies that are critical in the crypto sector. Schedule this consultation as soon as possible in your planning process.

What steps should I take to finalize my company structure for a crypto startup in Switzerland?

To finalize your company structure, secure expert guidance from legal and financial advisors familiar with Swiss regulations for crypto businesses. Collect multiple perspectives and conduct initial consultations with different experts to compare insights and develop a comprehensive strategy. Complete this step before making any final decisions on your structure.

Recommended

Comments